Background

From 2007 - 2012 I developed and managed youth financial literacy programs for REACH Community Development. My focus was initially set on finding ways to help kids grasp key concepts around the use of credit, which culminated in the development of the Credit Card Game.

Once this was firmly set in motion, I began exploring ways to teach kids how to get on the other side of compounding growth by investing from an early age. I used the real-life examples of my older students to show how even small monthly contributions could grow to more than $1 million if students started early enough.

My older students who were just starting their first jobs were thrilled, but many of my younger students wanted to know how they could begin right away to take advantage of even more exponential growth. At the time, I didn’t have a great answer to give them.

Introduction

Most Americans are not saving enough to retire comfortably. One reason (among many) is that most people do not begin saving or investing for retirement early enough. One study by Nationwide found the average age for opening a retirement account in the US is 31. Since the best opportunity to maximize compounding growth comes by starting at an early age, tools & strategies that help parents set their kids on a path to early saving and investing behavior can have a big impact.

We all know that compounding growth will lead to exponentially larger returns for each additional year they are allowed to compound. Unfortunately, by the time most people learn this they have already let many years slide by without getting started. Even the “good” examples in graphs like the one here do not begin until age 25. While that’s earlier than the national average of 31, it still leaves a substantial majority of potential gains from a lifetime of exponential growth unrealized!

What would the world be like if people began investing before they began spending?

Research & Discovery

Objective: Identify potential users and ways to help youth begin saving and investing for retirement from an early age.

Research Questions:

What are the educational barriers to teaching kids to invest early?

What are the logistical challenges to investing for retirement as a young person?

What kinds of tools are parents most interested in using to help their kids begin investing?

Methodology: Screener surveys to identify study participants;

User interviews to explore current approaches kids & money, ideas about early saving and investing, and interest in tools for promoting early investing behavior;

Usability testing to evaluate product prototypes.

Participant Characteristics: The primary characteristics of study participants will be:

Parents with children aged 18 or under.

Already giving their kids money, or considering doing so soon.

Interested in the idea of starting their kids saving & investing early.

Interviews

Data Collection & Analysis

Parents who fit the criteria above were interviewed about their own financial management habits, as well as their approaches to teaching their children. The interviews included questions about day-to-day money management, retirement planning and opportunities to share about how, when and why parents give their kids money.

Responses differed significantly from one parent to the next, including sometimes revealing substantial differences between parents of the same children. In order to discover actionable themes, I created an affinity map, grouping similar quotes and behaviors into categories. A few of the most important take-aways included:

Automation is the best way to ensure success in any financial practice. Any opportunity to “set and forget” will not only create successful habits, but also free up mental bandwidth to focus on other things.

Most people do not think about investing as important or viable before someone gets their first “real” job.

Debt is the biggest source of financial insecurity and stress.

Personas

To help me keep in mind who I was designing for, I created two personas using my interview data. Each of these personas combined data from multiple parents in order to create archetypes to represent larger subsets of parents.

Each of these personas then allowed me to create narratives and user stories that further crystallize the needs of prospective users, and possible solutions. They also provide a point of reference to come back to at each stage of development, to make sure that I am still designing features and solutions that are relevant to my target users.

How Might We

Armed with a good sense of my target audience and their most common needs and challenges, I used “how might we” questions to further clarify the goals of the project.

Empower

How might we help parents motivate and empower kids to invest from an early age?

Automate

How might we make the process of investing simple and automatic for young people?

Simplify

How might we make it easy for parents to teach kids good savings and investing habits?

Brainstorming revealed no shortage of possible solutions to these questions. Given the broad scope of the problem, and the fact that it encompassed both parents and children across their entire lifetimes, it soon became clear that I would have to focus in on solving just one piece of the puzzle to begin, while laying the groundwork for a larger ecosystem of solutions down the road.

Solutions

Narrative & User Stories

In order to better visualize a solution, I wrote a narrative about a 16 year old boy who already had $3,000 invested toward his retirement. By fleshing out his story and the tools he and his mother had used to get him on track, I was able to bring several of the ideas I had generated into sharper focus, while simultaneously culling ideas that didn’t fit the narrative.

I then pulled out 15 specific user stories from the narrative, which would help direct the design process. From these, I selected one user story to prototype and test:

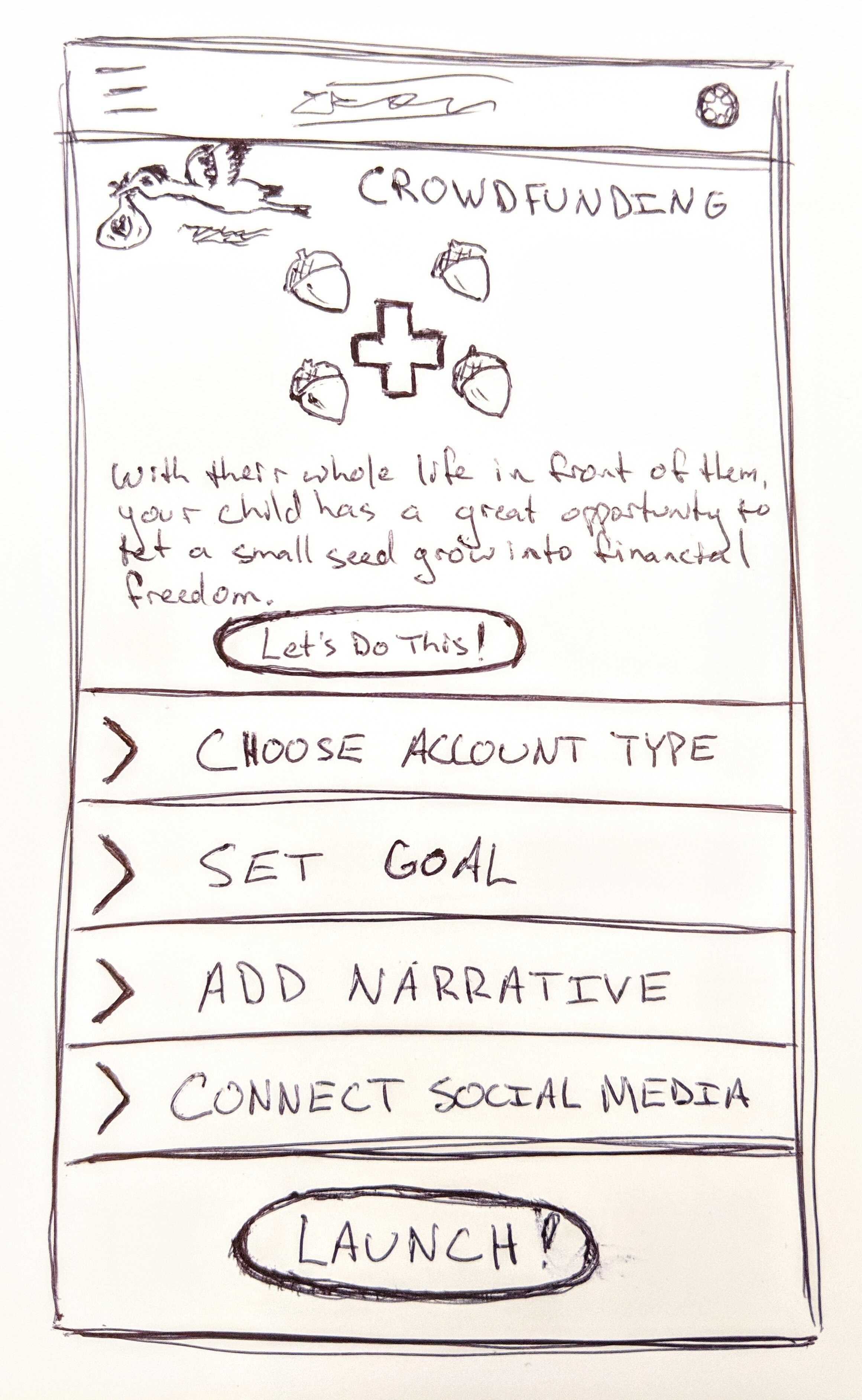

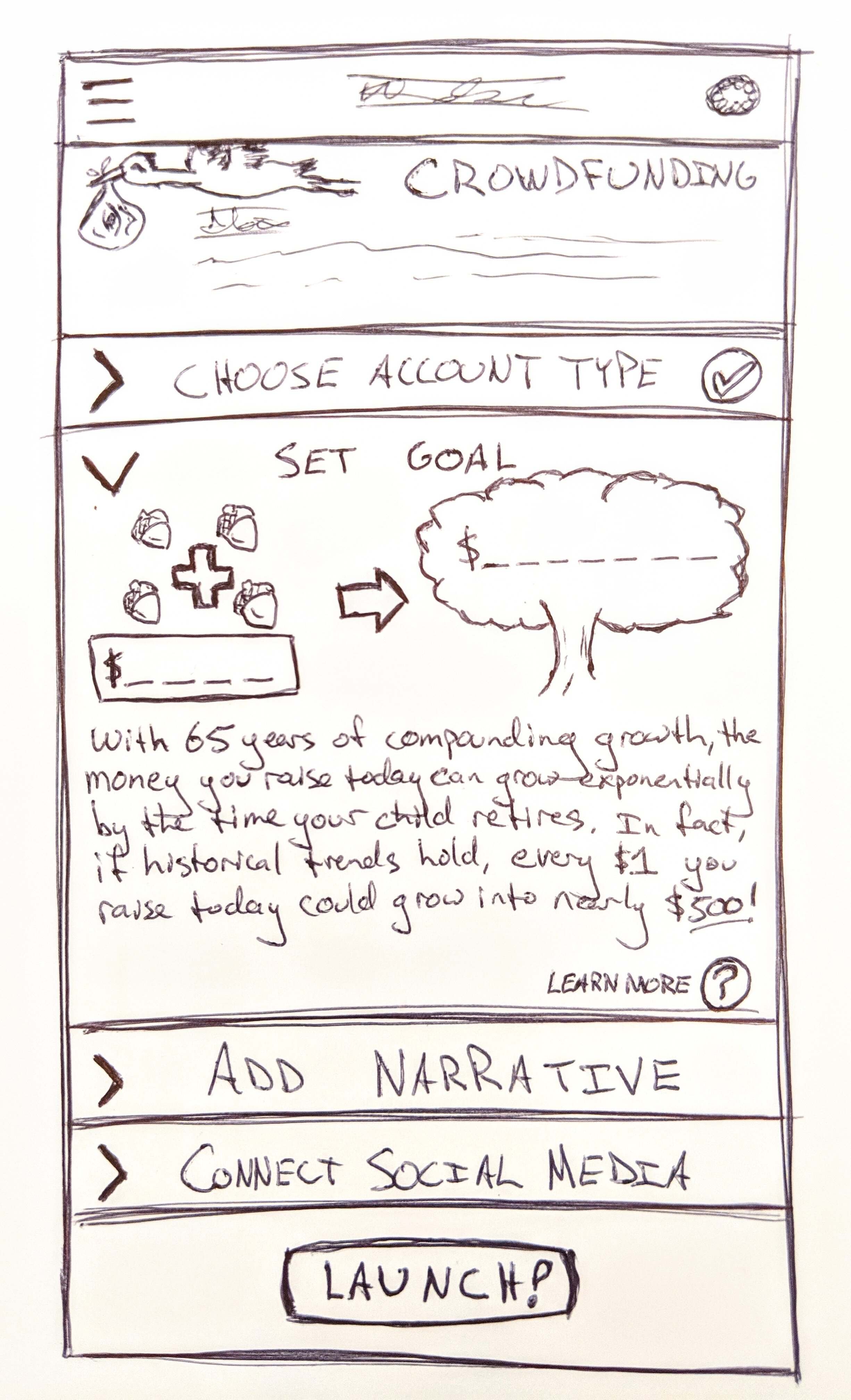

“As a parent, I want to collect donations from friends and relatives to begin investing for my child’s retirement.”

Sketching & Usability Testing

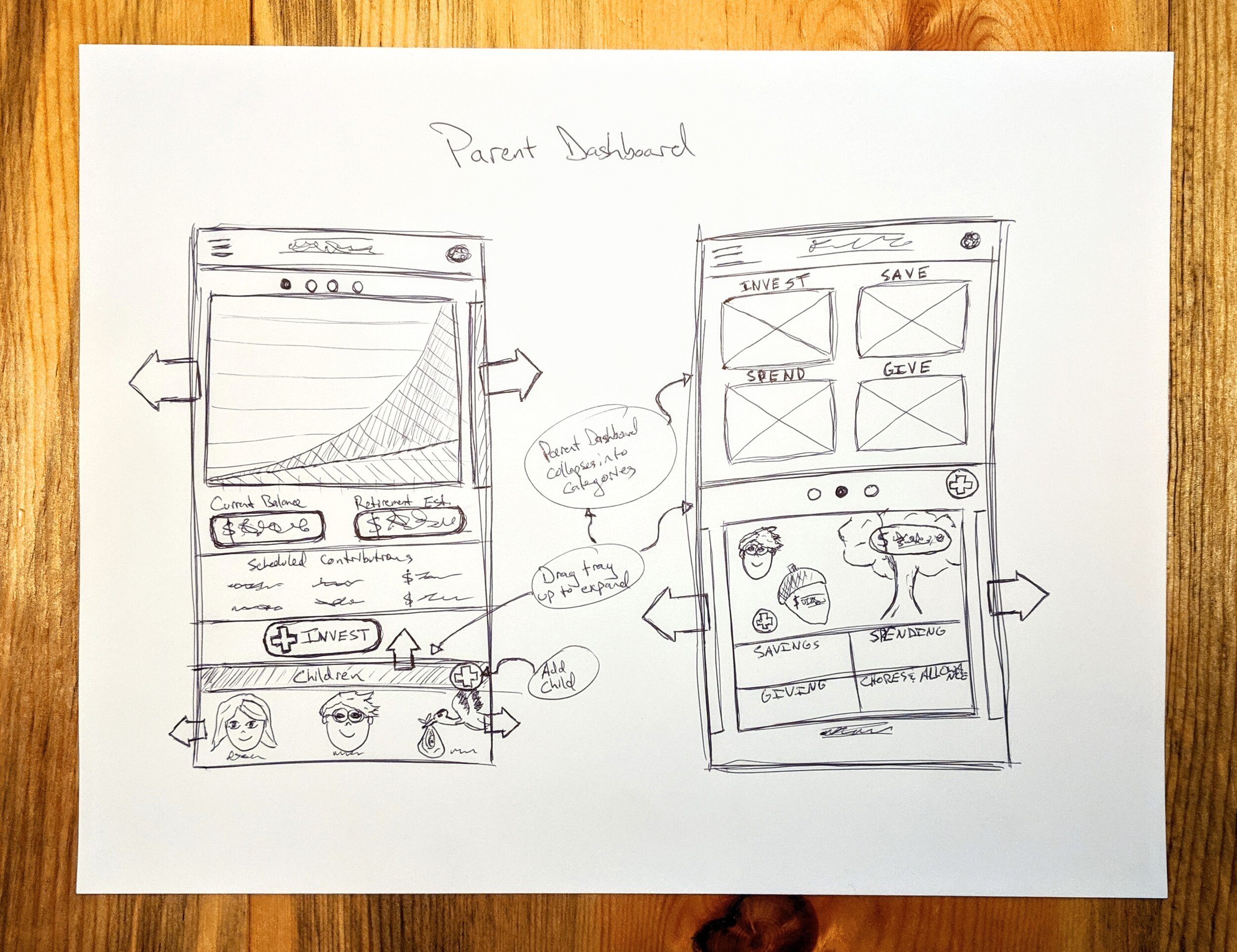

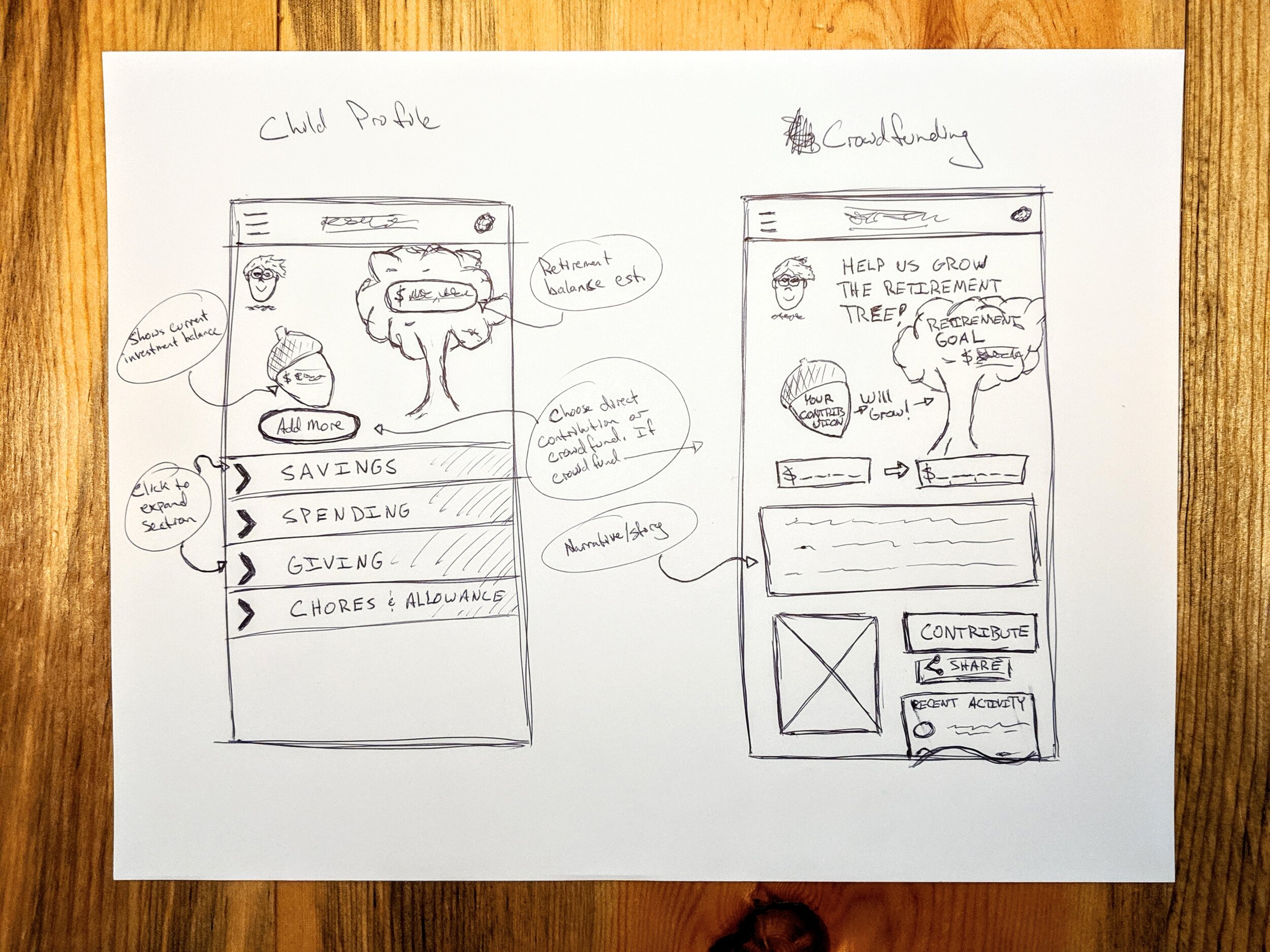

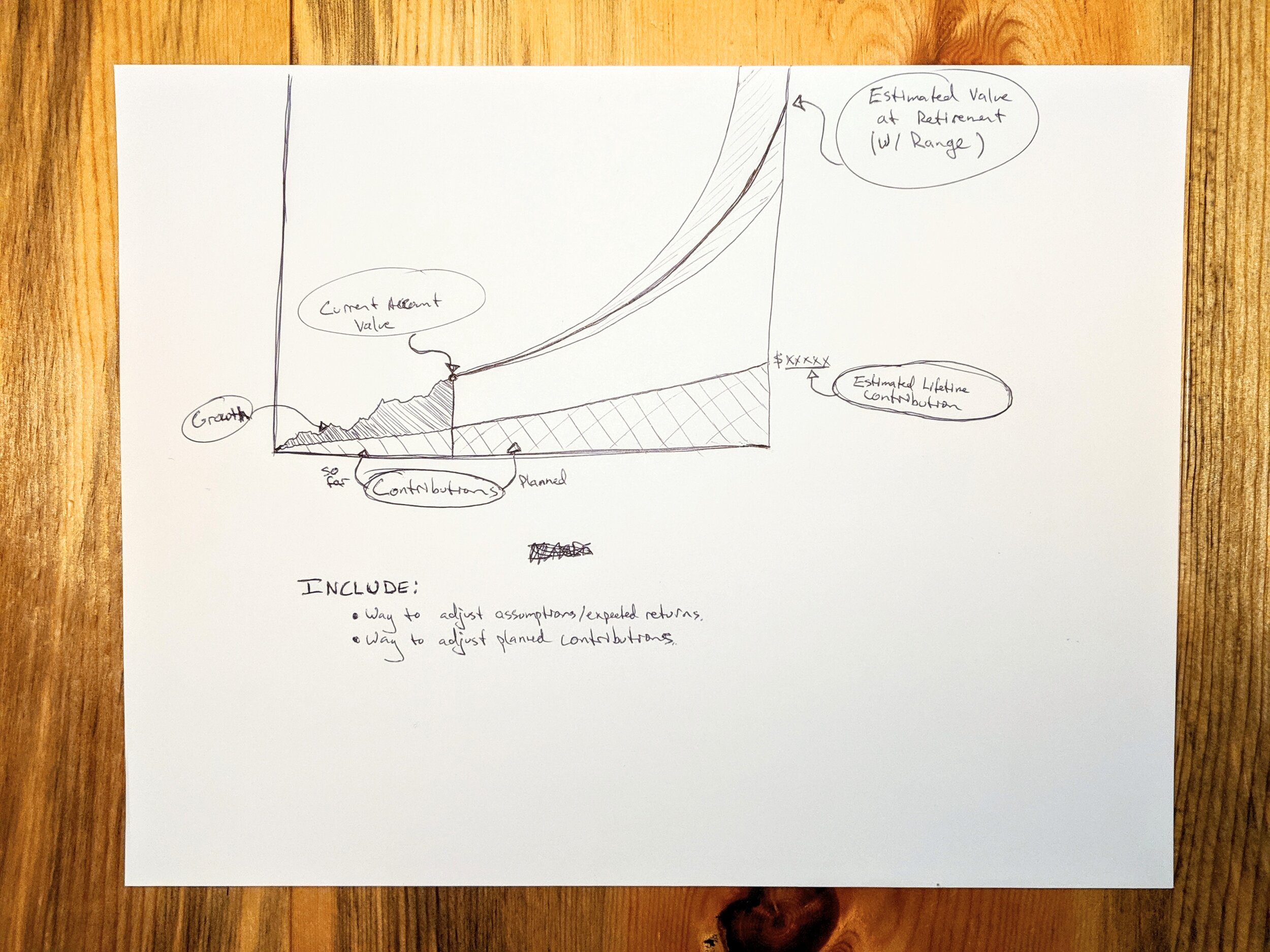

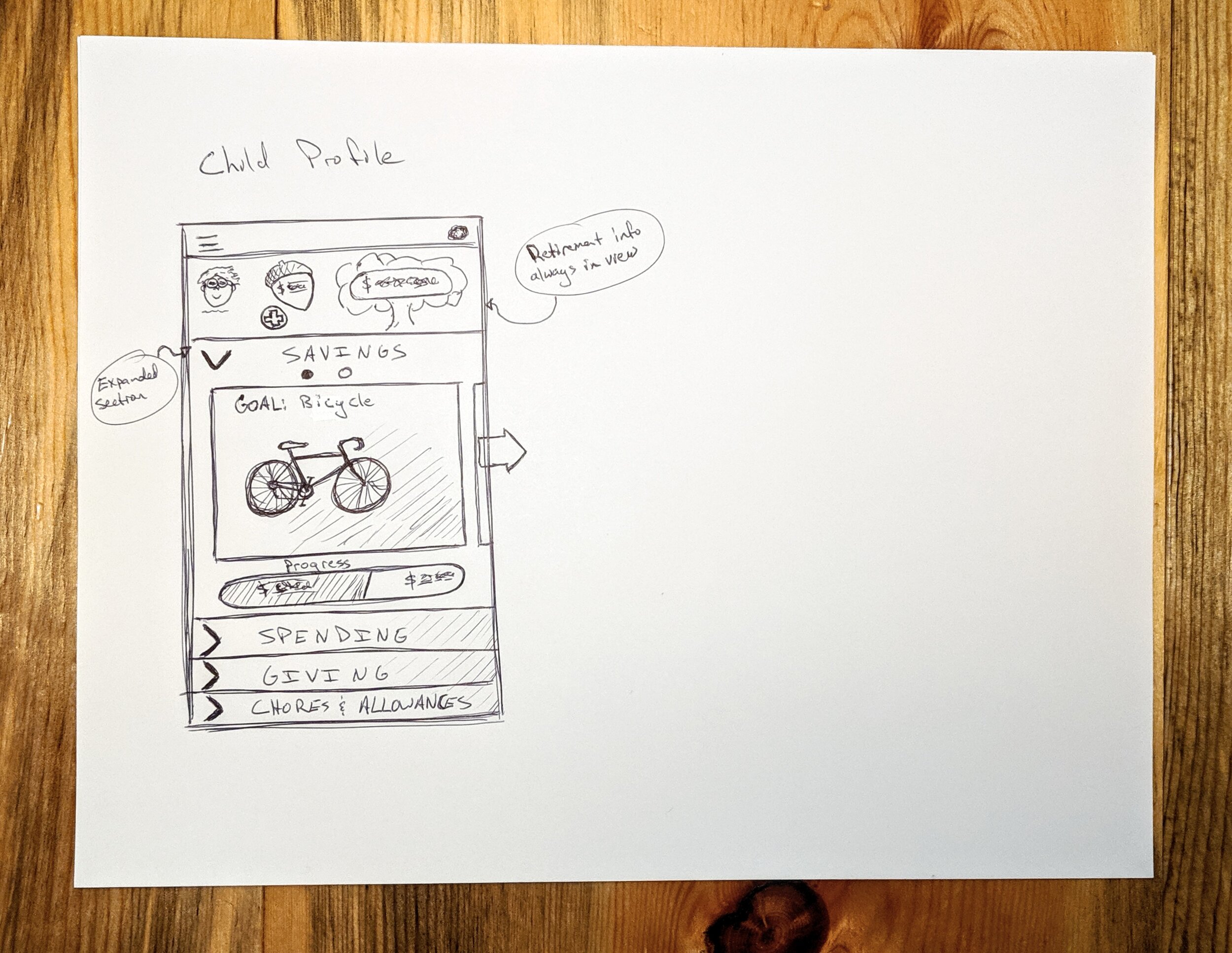

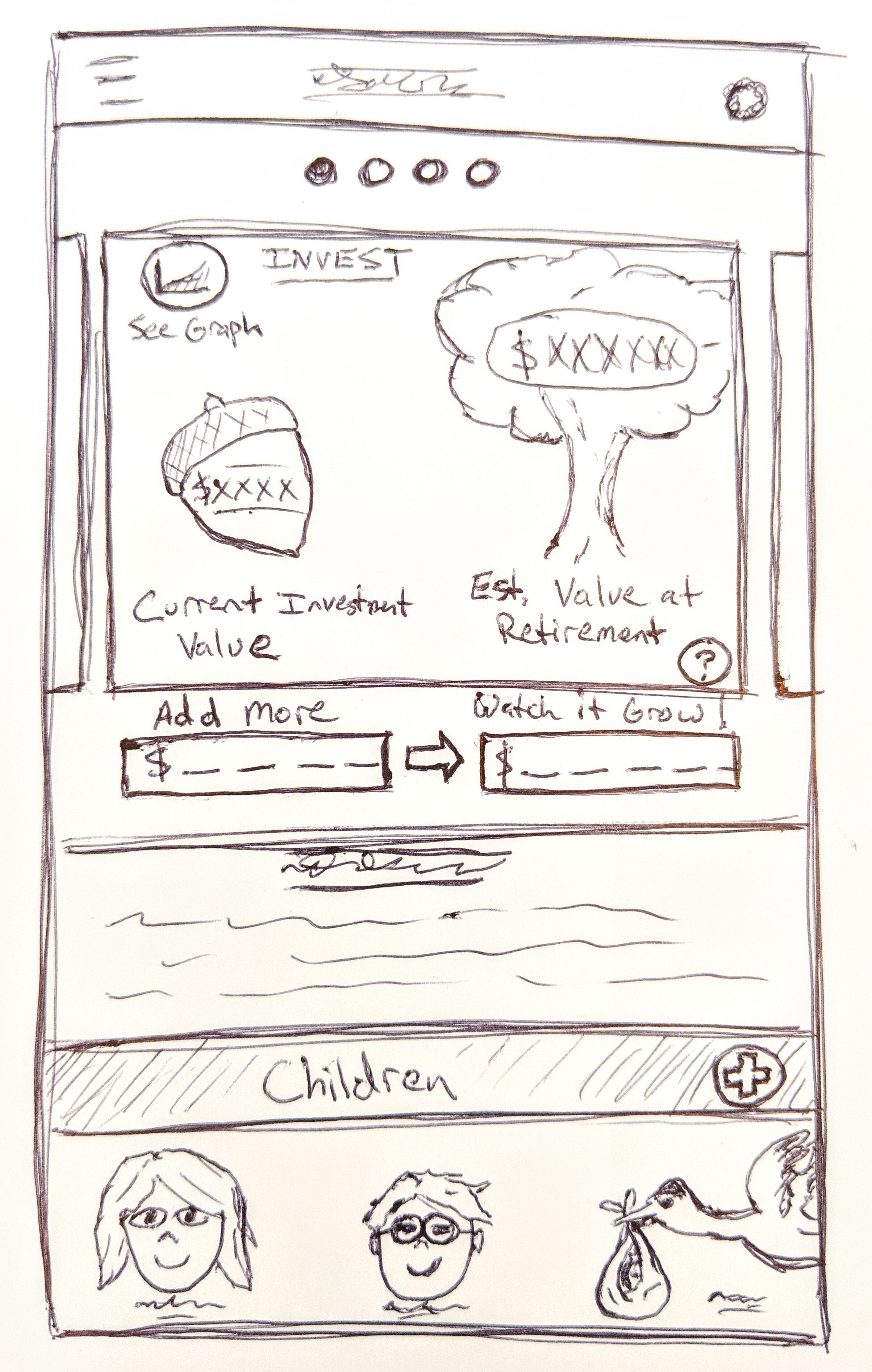

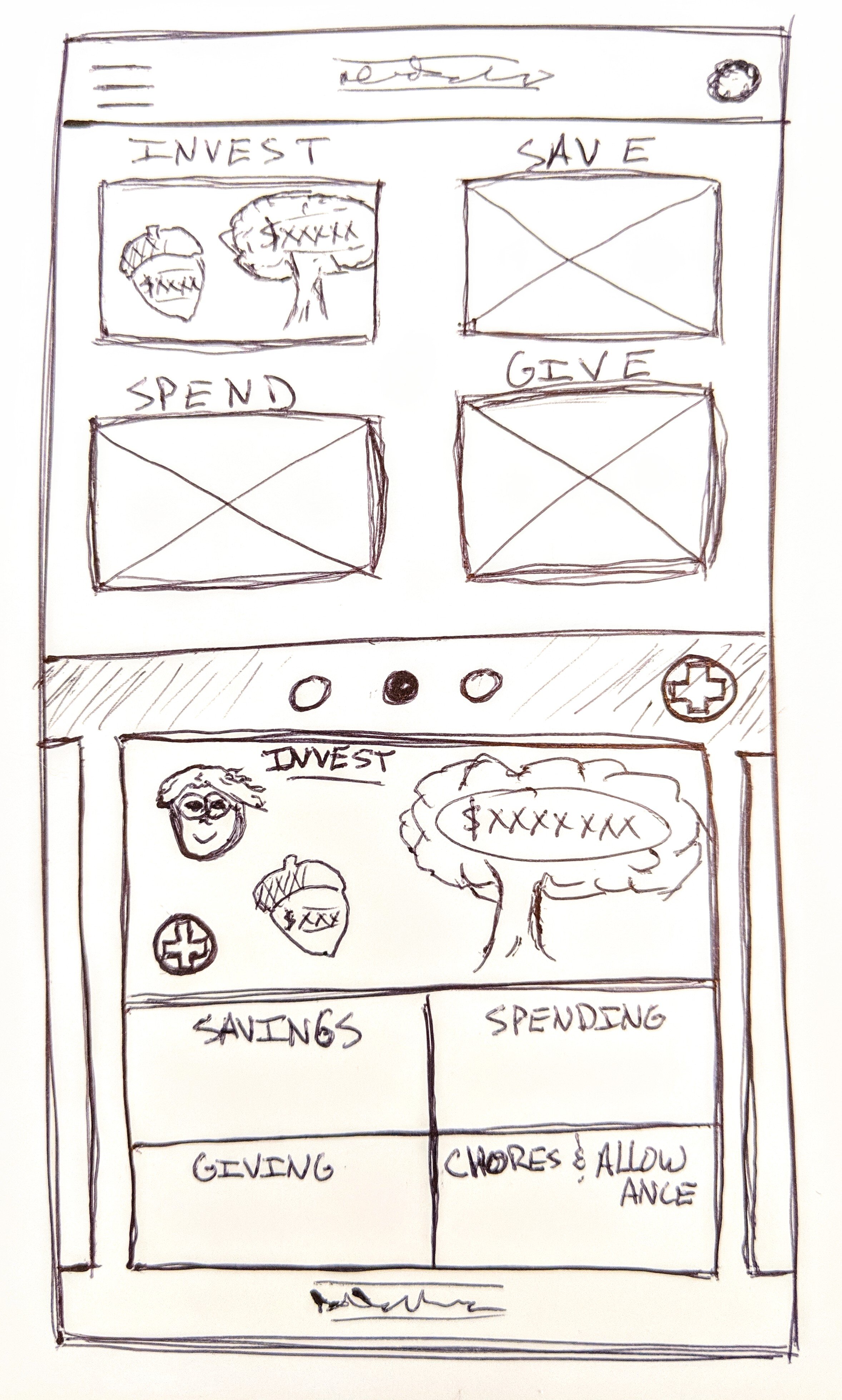

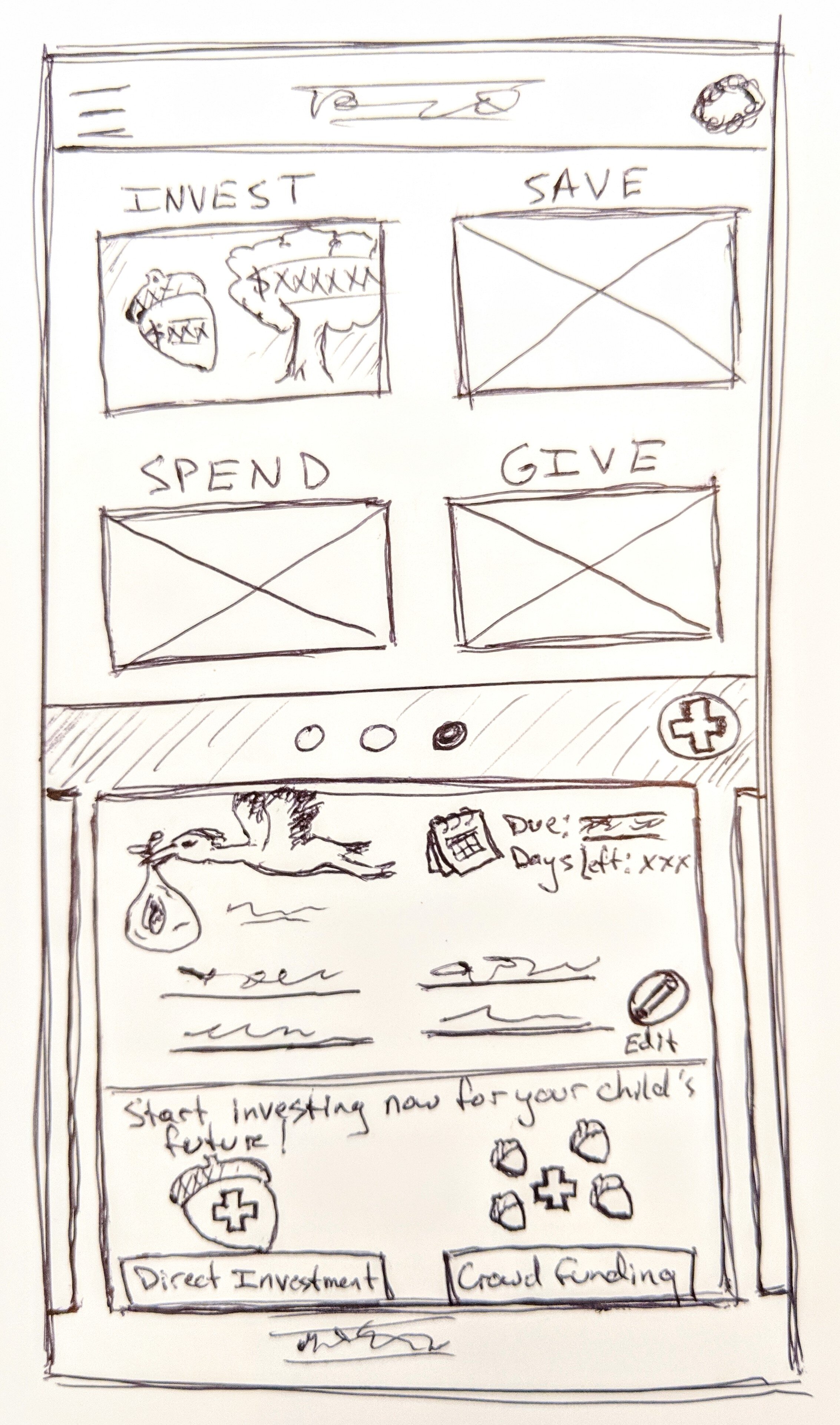

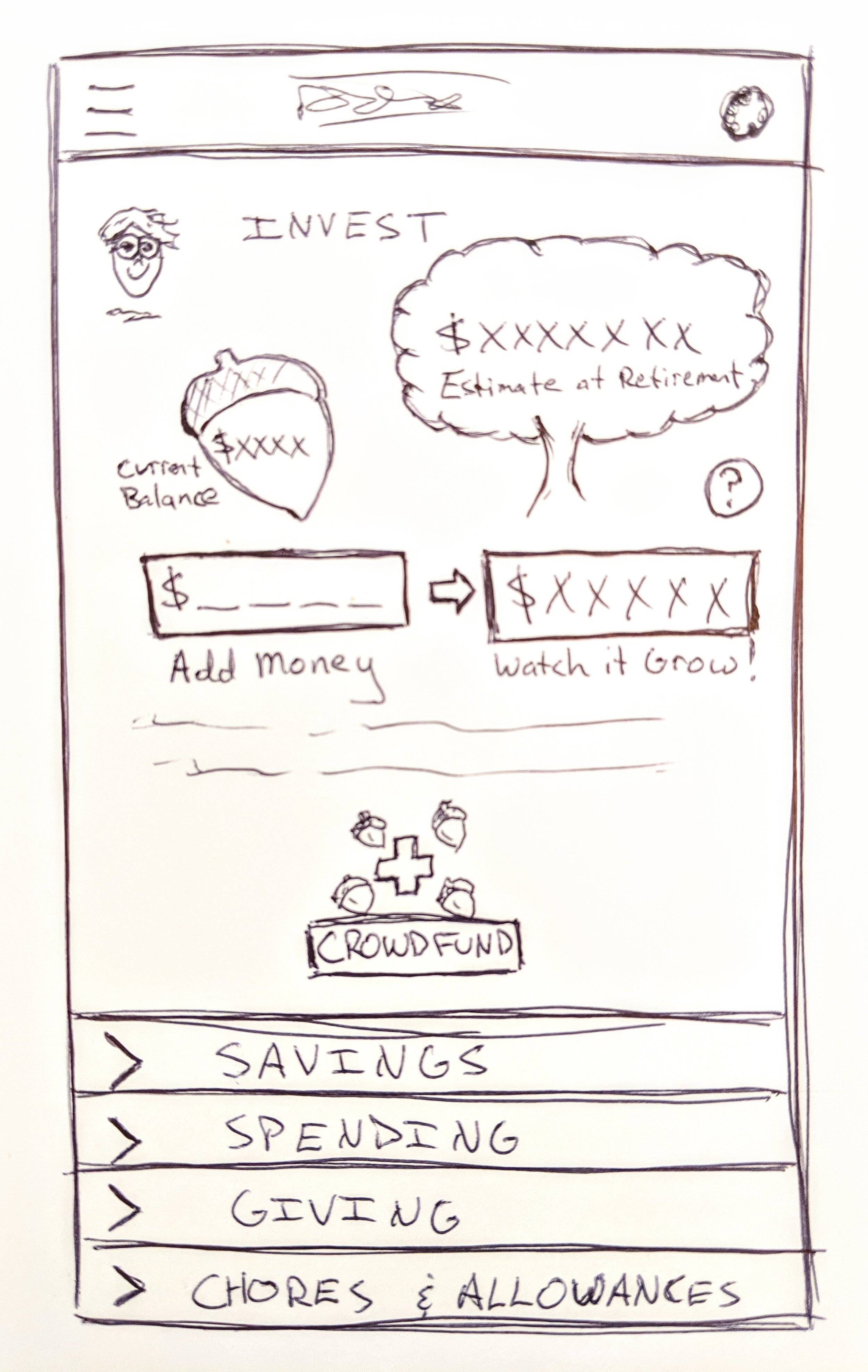

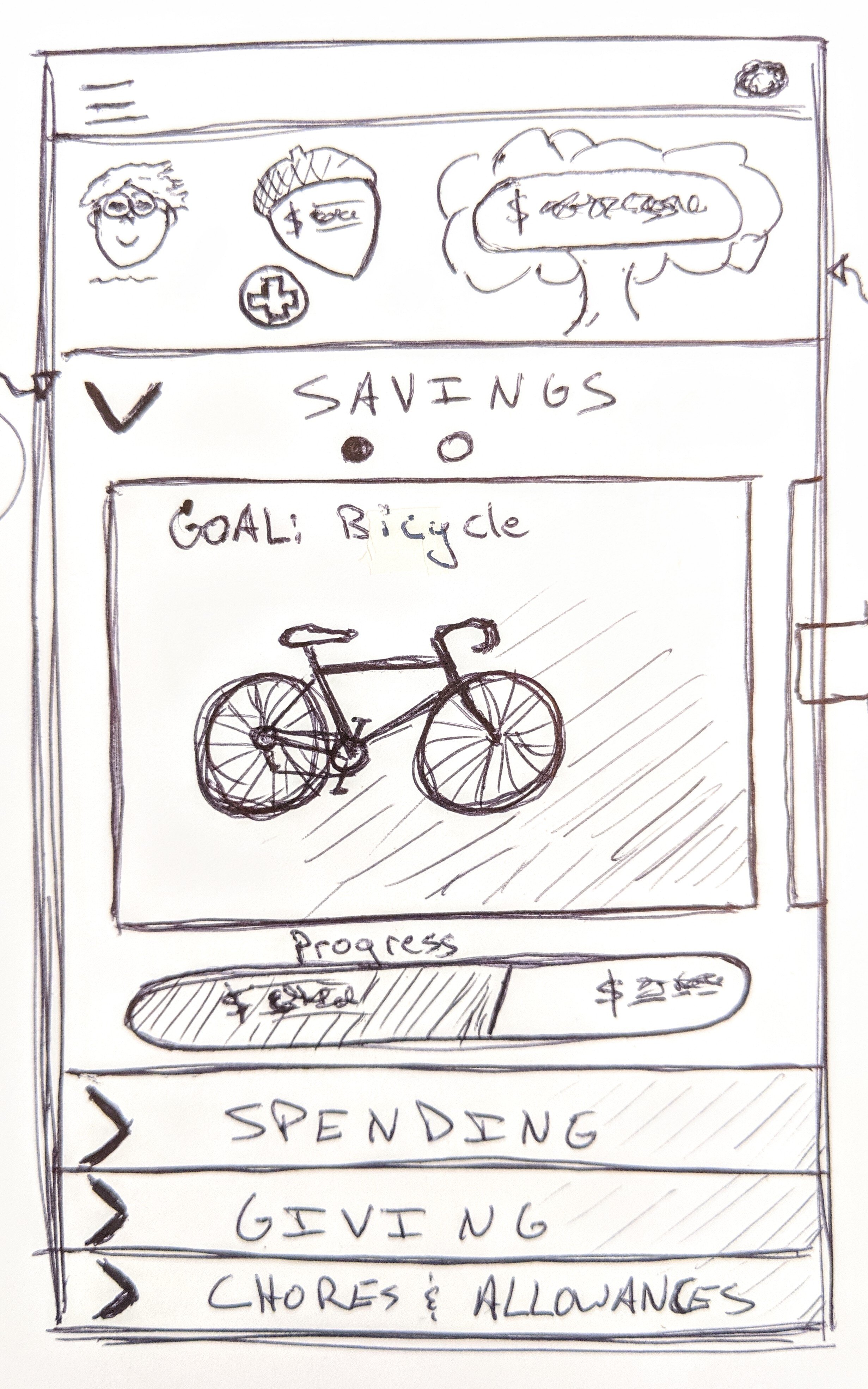

I began sketching ideas for an app that would achieve this goal. The bigger vision is to provide tools for parents and children to manage all aspects of their financial lives, from savings and investments to chores and allowances, but to begin much of that was left to the imagination while I focused on fleshing out the core functionality described above.

Guerrilla usability testing using paper prototypes allowed me to gain quick insights and begin iterating before investing much into my initial features and layouts.

Wireframes & Wireflows

Digital design began with basic wireframes to explore layouts and functionality. I started by fleshing out the “red route” of creating a crowdfunding campaign to fund a new retirement account for a baby on the way.

Early Prototype

Next I created a clickable prototype to demonstrate some of the key functionality.